Sunday Night Market Note

This is the members only note I am sharing with you for free. I will be offering this, including the videos for a small fee each month. This is the same content I share on my X account. If you think this content can help you consider joining through Substack or X.

Sunday Market note 11/03/2024

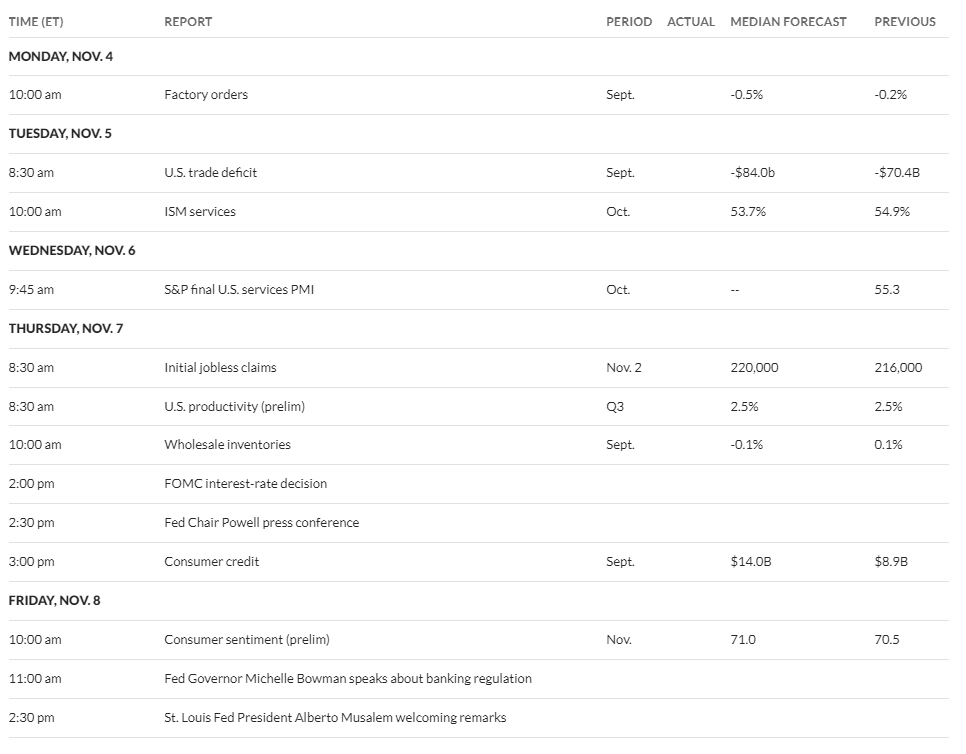

This week will likely be peak volatility with the presidential election Tuesday and FOMC rate decision and Jerome Powel remarks afterwards on Thursday. Plus another giant week of earnings.

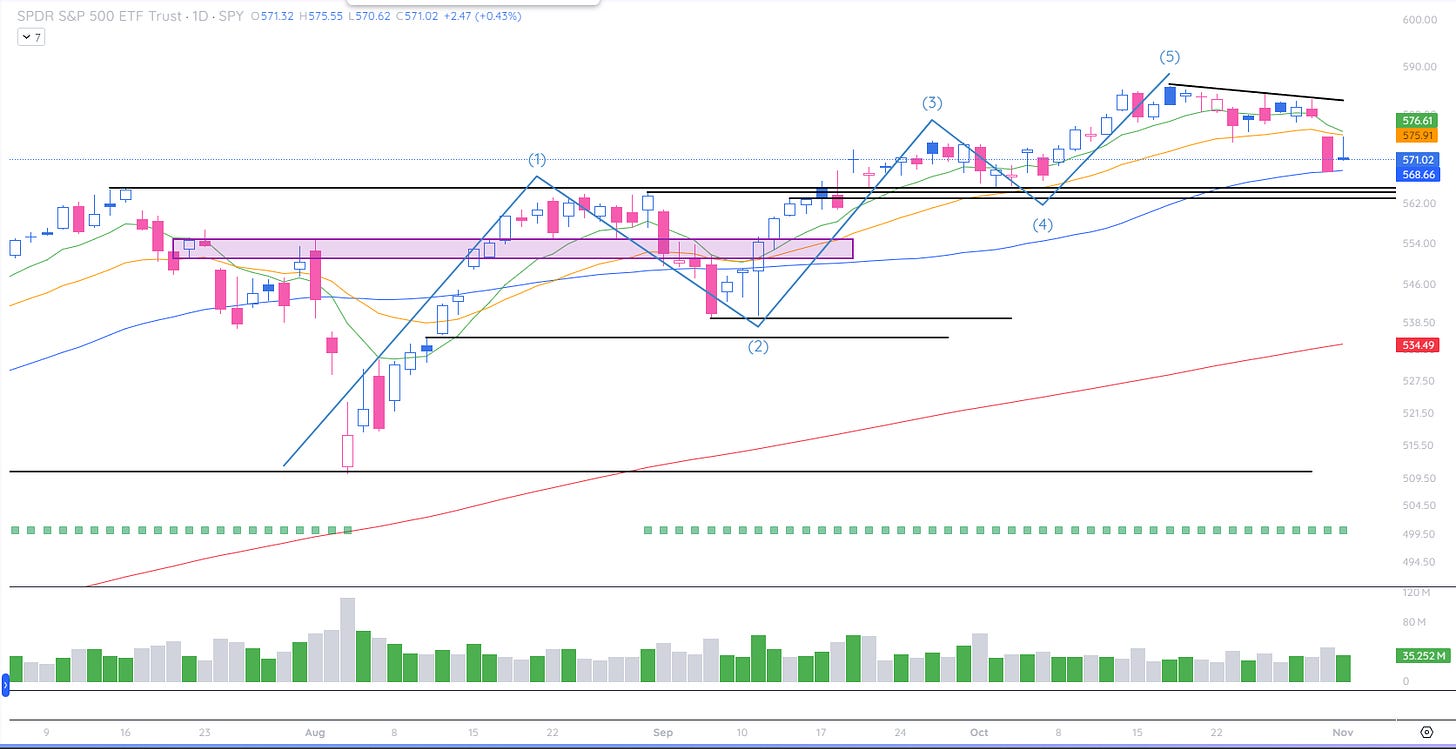

The SPY tested its 50dma and then had a weak bounce. The 562-565 area is expected to act as support, if it does not, then the market could have a much deeper correction.

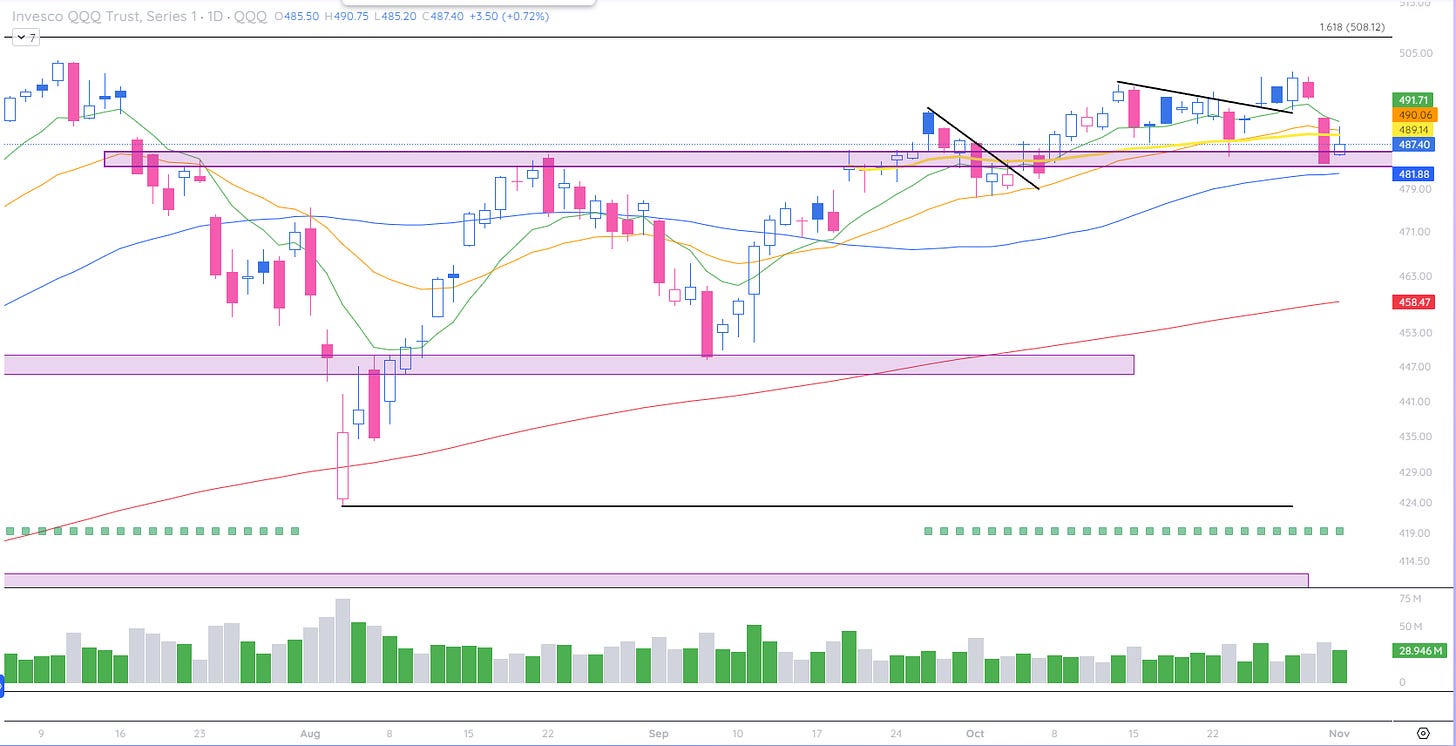

The Nasdaq is on support and right above its 50dma. The 482 area is the key area I’m watching. Above it I’m cautiously bullish, below it I’m more bearish.

The Small caps continue to be a mess. They are right on the 50dma, if they break lower the 209-210 area is the next potential area for support.

Semiconductors and housing look very weak, financials and transports are holding up better.

I continue to be cautious on our SPY chart which means tightening stops and raising higher levels of cash. Momentum is still negative, New lows are outpacing new highs, and we are staying in a bearish range in our FOMO indicator.

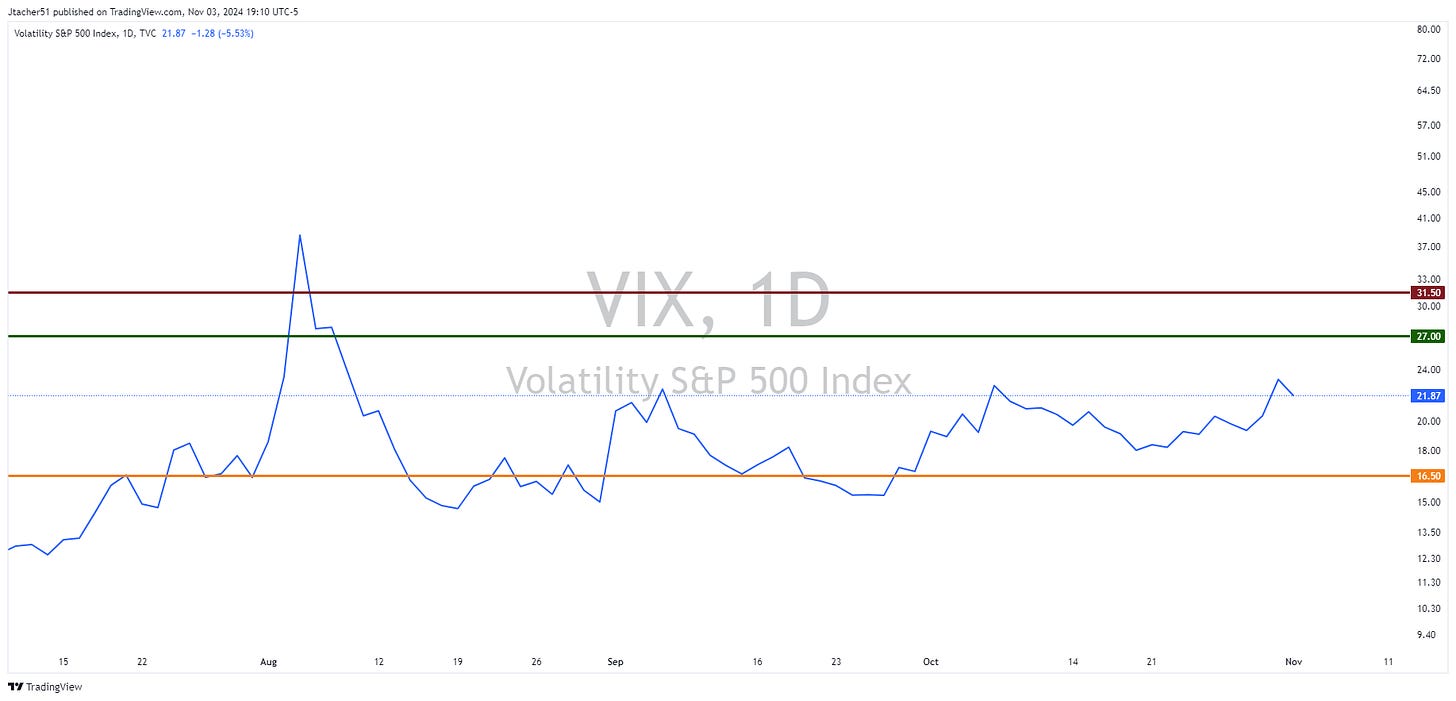

The VIX continues to be elevated near 22, but credit spreads remain tight. Breadth is deteriorating and sentiment is not extreme. The internals are indicative of a bearish/choppy/sloppy time in the market.

I cleaned up the watchlist in the weekend video and will continue once we get some more earnings reactions.

The Focus List video had three names on it. Many names were either extended or had earnings soon. I’d rather keep buys small this week with the expected volatility.

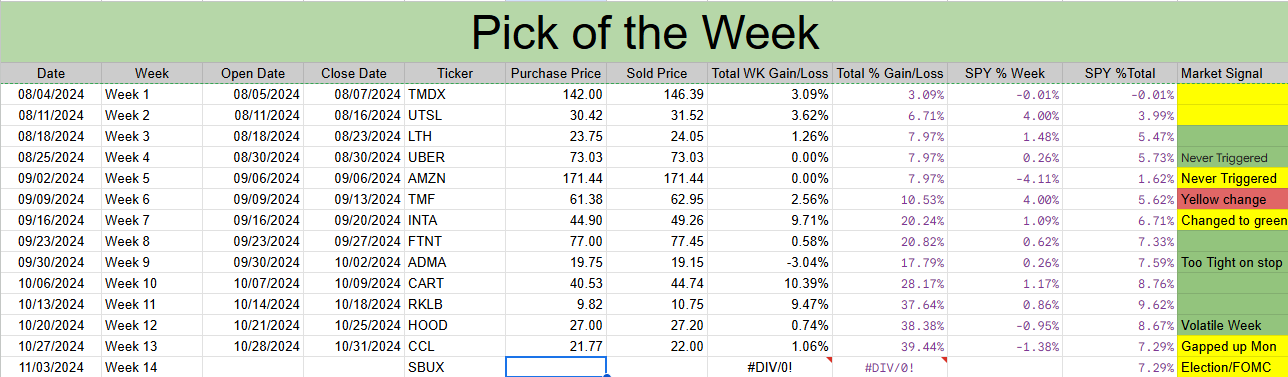

Our Pick of the week is Starbucks SBUX. The results have been really good so far. The name has to trigger, don’t just blindly buy!

Trading our system is going to give us many small wins, and some small losses. Every so often we will get big wins that really push the needle in our trading accounts.

Being consistent with our risk management and knowing the environment we are in is paramount to be successful. Right now I think we are in a cautious time.

This is where the patience part of trading comes in. Higher levels of cash and smaller size if you choose to trade makes sense. We have been through these cycles before, the time to make money will be in front of us again, right now is the time to keep the money we made. Patience. Take care. -Jack